6 Best Dental Credit Cards for Dental Work (2025)

In this article, we may include products or services we think are useful for our readers. If you buy through links on this page, we may earn a small commission to help fund our mission to create more healthy smiles. Here’s our process.

A credit card can make your elective or medically necessary dental work more affordable by reducing the amount of money you have to spend out of pocket. However, not all credit cards are right for dental work, and some may even be detrimental to your budget! Before you apply for all of the popular dental credit cards out there, here are some things to keep in mind as you plan your upcoming oral health procedures.

What Are Dental Credit Cards?

Dental credit cards are any credit card that can be used to pay for dental work. Sometimes companies specialize in medical expenses or veterinary bills. Like any other credit card, dental credit cards are subject to fees and interest rates, which means that you need to know the best way to use these cards to make them work for your personal budget. For instance, you wouldn't want to use dental credit cards on something that's covered 100% by your dental insurance policy or your HSA/FSA funds, but you would if it's an elective cosmetic procedure or something that goes beyond what your benefits actually cover.

Look For True No-Interest Credit Cards

No-interest credit cards can be a great for financing dental work and not have to worry about extra fees on top of your monthly payments.

No-interest credit cards are ideal for situations where you can afford to make low monthly payments but not all of it upfront.

Unfortunately, most of these credit cards do not exist for everyone (usually need a good credit score). Credit scores play a major role in credit approval. Some deferred interest card companies will advertise having a no-interest period but start charging interest from day one or after a short grace period, where you have to make minimum monthly payments before it starts charging interest. When evaluating what type of dental credit card to get, it is important to read all of their fine print before signing up and make sure that they are true no-interest cards.

6 Best Credit Cards For Dental Work

Discover, Chase, American Express, and U.S.Bank all offer credit cards that you can use toward the price of your dental procedures. Most of these cards are easy to apply for if you have fairly good or excellent credit. But the repayment terms may vary from one to the next. And if you’d like the option of using your credit card toward anything that isn’t dental related, be sure to find out if it’s only available for medical expenses or other items as well. There may even be restrictions on the interest rate, depending on what you’re paying for with the card. Depending on the company that your card is through, you may have restrictions.

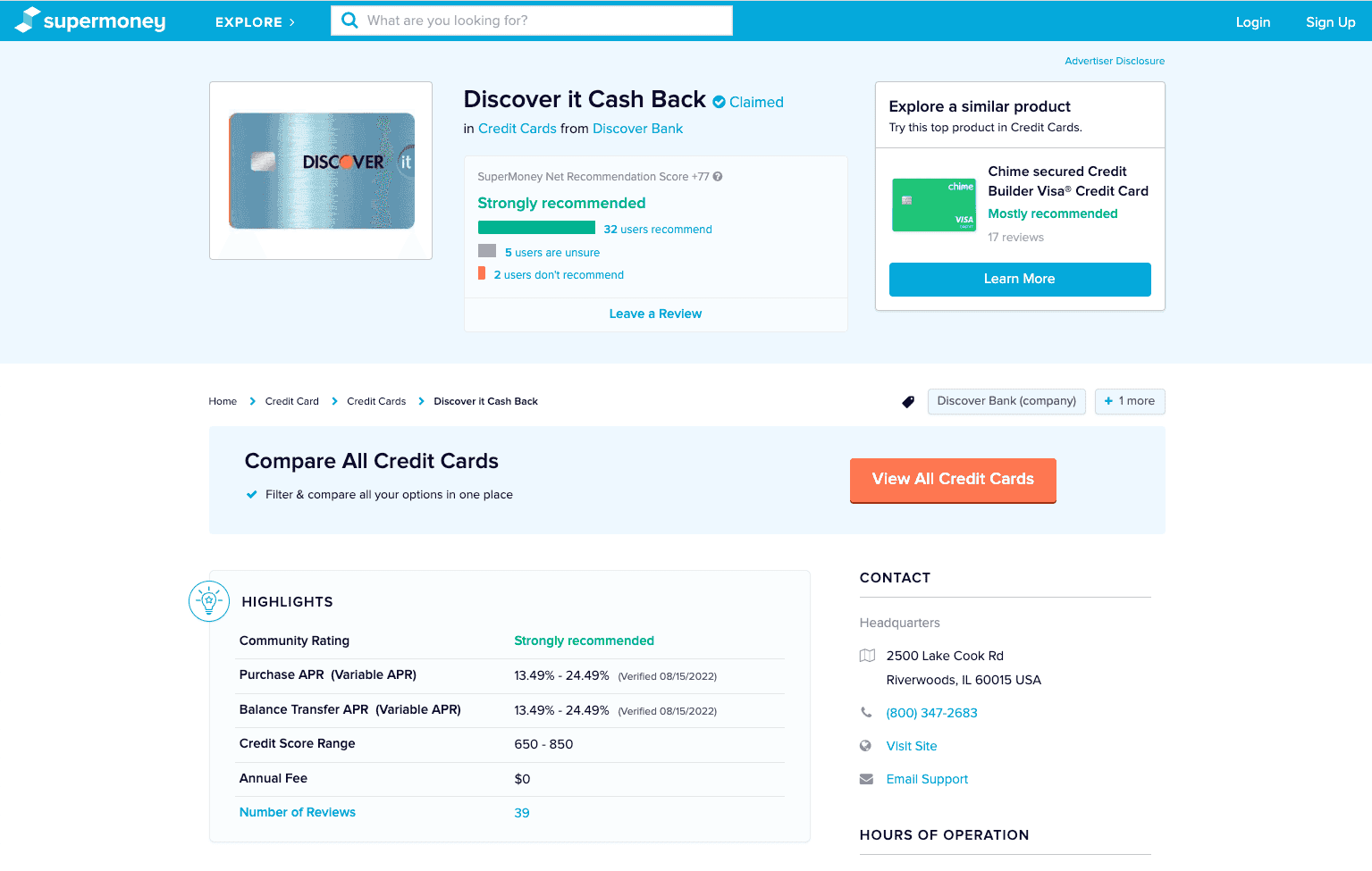

1. Discover it Cash Back

Best Overall Credit Card for Dental Care

Discover Bank offers the Discover it Cash Back card, which provides a maximum cashback rewards rate of up to 5x and a 0% APR balance transfer intro rate for up to 15 months, longer than the typical 12-month period. New cardholders can also benefit from a 0% APR rate on new purchases for up to 14 months, and the card has a variable purchase APR ranging from 13.49% up to 24.49%, which is competitive. Additionally, the card does not have an annual fee, making it an attractive option for those seeking a low-maintenance cashback card.

This card has great benefits too, the Discover it Cash Back offers gas rewards of 1% cashback to 5% cashback on eligible fuel purchases. Other benefits include identity theft protection, price protection, and fraud protection. To qualify for the card, a fair or better credit score above 650 is required. Overall, the Discover it Cash Back card provides several advantages and minimal drawbacks, making it a solid option for many consumers.

Quick Facts:

- Earn 5% cash back at different places each quarter like gas stations, grocery stores, restaurants, Amazon.com and more, up to the quarterly maximum, each time you activate.

- Potentially lower than average purchase APRs.

- 0% APR balance transfer intro rate on balance transfers for up to 15 months.

- 0% APR on new purchases during the first 14 months. There is then a variable purchase APR that ranges from 13.49% up to 24.49%.

Cons:

- Does not offer a signup bonus.

- Charges a 3% balance transfer fee.

| Intro (Purchases) | Intro (Transfers) | Regular APR | Annual Fee | Credit Needed |

|---|---|---|---|---|

| 0% for 15 months | 0% for 15 months | 19.24% - 29.24% (Variable) | $0 | 650 to 850 |

2. Quicksilver from Capital One

Best Cashback Card

You can pay for dental care and earn cash back with the Quicksilver card. They offers a 0% APR balance transfer intro rate for up to 15 months, along with a 0% APR on new purchases for the same period, making it an attractive option for those looking to save on interest charges. Additionally, new cardholders can earn a signup bonus of up to $150 if they spend $500 within three months. The card has no annual fee, which is great for those seeking a low-maintenance cashback card.

The Quicksilver card also offers multiple credit card benefits such as rental insurance, access to a concierge, extended warranty protection on purchases, identity theft protection, travel accident insurance, travel assistance, and fraud protection. However, the card charges a 3% balance transfer fee, and the variable purchase APR ranges from 16.49% up to 26.49%. To qualify for the card, a good or better credit score is required, and those with scores below 700 will have low approval odds. Overall, the Capital One Quicksilver card is a competitive cashback card that offers a range of features and benefits, making it a strong contender for those looking for a low-maintenance, low-fee card.

Quick Facts:

- Earn unlimited 1.5% cash back on every purchase

- 0% APR balance transfer intro rate on balance transfers for up to 15 months.

- 0% APR on new purchases during the first 15 months. There is then a variable purchase APR that ranges from 16.49% up to 26.49%.

- No annual fee.

- Multiple credit card perks.

- Identity Theft Protection.

- Travel accident and travel assistance insurance.

- No foreign transaction fee.

Cons:

- You need good credit to qualify.

- Charges a 3% balance transfer fee.

| Intro (Purchases) | Intro (Transfers) | Regular APR | Annual Fee | Credit Needed |

|---|---|---|---|---|

| 0% for 15 months | 0% for 15 months | 16.49% up to 26.49% (Variable) | $0 | 640 to 700+ |

3. American Express® EveryDay® Credit Card

Best Reward Credit Card

Want to earn points when your pay for your dental work? The Amex EveryDay® Credit Card is for you. This is a rewards card issued by American Express National Bank, offering benefits to cardholders who prefer a low-maintenance rewards card. It provides an introductory 0% APR rate on balance transfers and new purchases for up to 15 months, which is longer than the average period of 12 months. Additionally, new cardholders can earn 10,000 Membership Rewards® Points after spending $1,000 on purchases in the first 3 months. They can also earn 20% more points if they use their card 20 or more times on purchases in a billing period.

However, it charges a 3% balance transfer fee and a commission of 2.7% for foreign transactions. It also has a variable purchase APR ranging from 15.99% up to 26.99%. Nonetheless, it provides multiple credit card perks such as rental insurance, emergency support, identity theft protection, travel assistance, and fraud protection. Fair or better credit is required for approval, and the card reports to multiple credit bureaus.

Quick Facts:

- Potentially lower than average purchase APRs.

- 0% APR balance transfer intro rate on balance transfers for up to 15 months.

- 0% APR on new purchases during the first 15 months. There is then a variable purchase APR that ranges from 15.99% up to 26.99%.

- No annual fee.

- Cardholders can earn rewards on their purchases.

Cons:

- Charges a foreign transaction fee of 2.7%.

- Charges a 3% balance transfer fee.

| Intro (Purchases) | Intro (Transfers) | Regular APR | Annual Fee | Credit Needed |

|---|---|---|---|---|

| 0% for 15 months | 0% for 15 months | 15.99% up to 26.99% (Variable) | $0 | 640 to 850 |

4. US Bank Visa Platinum Card

Best Long Term 0% APR

The US Bank Visa Platinum Card is a credit card issued by U.S. Bank. It offers a number of benefits to potential cardholders, including an introductory 0% APR rate on balance transfers for up to 20 months, as well as an introductory 0% APR rate on new purchases for up to 20 months. The card has a variable purchase APR that ranges from 16.74% up to 26.74%, which is competitive with other credit cards in the market. Additionally, the card does not charge an annual fee, making it a good option for people looking for a low-maintenance card.

Overall, the US Bank Visa Platinum Card is a good option for people with good credit who are looking for a low-maintenance credit card with some additional perks.

Quick Facts:

- 0% APR balance transfer intro rate on balance transfers for up to 20 months.

- 0% APR on new purchases during the first 20 months. There is then a variable purchase APR that ranges from 16.74% up to 26.74%.

- No annual fee.

Cons:

- You need good credit history to qualify.

- Does not offer rewards or cash back.

- Charges a foreign transaction fee of 3%.

- You don't earn rewards on every purchase.

- Charges a 3% balance transfer fee.

| Intro (Purchases) | Intro (Transfers) | Regular APR | Annual Fee | Credit Needed |

|---|---|---|---|---|

| 0% for 20 months | 0% for 20 months | 16.74% up to 26.74% (Variable) | $0 | 700 to 850 |

5. Chase Freedom Unlimited Visa

Best Intro Bonus

The Chase Freedom Unlimited Visa is a cashback card offered by Chase Bank that comes with a range of features and benefits. The card offers a 0% APR balance transfer intro rate for up to 15 months, which is longer than the industry average of 12 months, as well as a 0% APR on new purchases for the same period. Cardholders can also benefit from a $200 signup bonus if they spend $500 within three months. The card has no annual fee, making it a low-maintenance option for those who want to earn cashback on eligible purchases. However, it does have a 5% balance transfer fee, and foreign transactions incur a commission of 3%.

In addition to its cashback rewards, the Chase Freedom Unlimited Visa offers multiple credit card perks, including rental insurance, emergency support, extended warranty protection on purchases, identity theft protection, purchase protection, travel assistance, trip cancellation insurance, and fraud protection. Cardholders can also access their credit score for free. While the card has a higher-than-average purchase APR ranging from 19.24% up to 27.99%, it can be a good option for those with fair or better credit, as it reports to multiple credit bureaus.

Quick Facts:

- $200 signup bonus if they spend $500 within three months

- 0% APR balance transfer intro rate on balance transfers for up to 15 months.

- 0% APR on new purchases during the first 15 months. There is then a variable purchase APR that ranges from 19.24% up to 27.99%.

- No annual fee.

Cons:

- Higher than average purchase APRs.

- Charges a foreign transaction fee of 3%.

- Rewards bonus rate of only 1.5% on most everyday purchases.

- Charges a 5% balance transfer fee.

| Intro (Purchases) | Intro (Transfers) | Regular APR | Annual Fee | Credit Needed |

|---|---|---|---|---|

| 0% for 15 months | 0% for 15 months | 19.24% - 27.99% (Variable) | $0 | 640 to 850 |

6. CareCredit

Good for Bad Credit

CareCredit may not be the best option for paying for medical expenses its a good option if you have poor credit. Although it offers special financing options that you may not be able to get with other cards, be careful as there are some drawbacks. With CareCredit, you will be charged interest on purchases that are not paid off within the promotional period, and the interest rates are quite high. The shorter-term financing options have high-interest rates, which can add up quickly, especially if you have a large balance. The longer-term financing options may offer a reduced 14.90% - 26.99% APR, but the interest rates are still high, and you will be required to make fixed monthly payments until the balance is paid in full.

CareCredit reports to credit bureaus, and missing payments or carrying a high balance could negatively impact your credit score. Before applying for CareCredit, make sure to read the account agreement carefully and understand the terms and conditions.

Quick Facts:

- Longer repayment terms than traditional credit cards up to 48 months

- Purchases of $1,000 or more may be eligible for a 24 months offer with a 14.90% APR, a 36 months offer with a 15.90% APR or a 48 months offer with a 16.90% APR.

- Purchases of $2,500 or more may be eligible for a 60 months offer with a 17.90% APR.

Cons:

- Deferred interest introductory period

- No benefits like cash back or earning reward points

- Intro (Purchases)

- 0% for 6 to 48 months

| Intro (Purchases) | Intro (Transfers) | Regular APR | Annual Fee | Credit Needed |

|---|---|---|---|---|

| 0% for 6 to 48 months | N/a | 14.90% - 26.99% (Variable) | $0 | 600 to 700+ |

When Should You Use A Credit Card For Dental Work?

There are a few instances where it may be worth it to use a credit card for dental work as opposed to saving up to pay for it out of pocket dental costs. If you don’t have dental insurance but need treatments like wisdom tooth removal, root canal therapy, or major restorative work, it’s financially smarter to use a low-interest credit card than to wait until those conditions get worse (because they’ll only be more expensive to treat later.)

It might also be worth using a credit card if you plan on paying off the balance right away. Especially if you get points back or airline miles on it.

When you have the cash to pay off your dental credit card balance as soon as possible, then it probably isn’t worth taking out a new card or loan. But if you already have a card or don’t have the cash, it would be a fiscally smart choice.

Care Credit vs. Regular Credit Cards

CareCredit is a special type of credit card with monthly payment plans that can be used for dental treatments and other medical expenses. It has an deferred interest period of up to 18 months in some cases and no annual fee, which makes it different from traditional credit cards for dental treatment. Some people may only get 6 or 12 months, while others can get up to 24 (your credit score and the amount of the loan will come into play.)

CareCredit uses deferred interest. There’s no interest IF the balance paid in full promotional period ends (6, 12, 18, or 24 months.) This allows you to pay off your dental treatment without being charged interest free period. You can find true no interest credit cards with 12 to 18 month periods which is the better deal if your credit score is good. A promotional period with deferred interest can be tricky and you could pay interest that you didn't plan for.

On the flip side, a traditional credit card is suitable for dental treatment if your credit score is good and pay your amount due on time every month. If you have poor credit, you’ll have to pay higher interest rates, but when compared with other types of dental financing, it may be more affordable and give you a longer period of time to pay off the balance. The downside of using a regular credit card is that you’ll probably be charged higher interest rates, less flexible repayment term or find one with zero interest introductory period.

Dental Loans vs. Credit Cards: Which Is Better?

Dental loans (personal loans) and credit cards both have their perks, but you still need to crunch the numbers. A dental loan is a loan you take out from your bank or credit union (or even an online lender,) while a credit card might have an immediate application and approval process when you’re still at the dentist’s office, meaning you won’t have to wait to get treatment. Typically, it’s more convenient to get a dental credit card than it is to go through the process of taking out a separate individual loan to cover dental work. But if the procedure is extremely expensive, a dental loan may be your best bet. I have an article on the best dental loans that talks about how to finance dental work with a personal loan.

Related: Best Dental Loans (personal loans) For Dental Financing

Benefits Dental Financing with Credit Cards

With dental credit cards you get perks like:

- The ability to pay for same-day or emergency treatment without having to wait.

- They’re accepted at practically every dentist’s office.

- The introductory interest rates are extremely affordable.

- The possibility to pay off the entire balance without paying a penny in interest.

- Increasing your credit score when you pay your balance on time each month.

- The ability to use your card on any dental procedure, no matter what it is.

Can I Get A Dental Card With Bad Credit?

It is possible to get a dental credit card even if you have bad credit. But you might not get as long to pay off your balance or the interest rate may be higher than someone with excellent credit. If you’re not able to get qualified for dental credit cards because of your credit score, the best thing to do is to try to take out a private personal loan through your personal bank or a credit union. Finding a way to pay for dental care with bad credit is out there but you have to do your research.

Related: Best Dental Financing With Bad Credit

How Much Do Dental Treatments Cost?

A typical dental procedure may cost a few hundred dollars or up to several thousand dollars. For instance, you might need an emergency tooth extraction that is $100-200, or you could be eyeballing a smile makeover with dental implants and porcelain crowns at over $10,000. You’ll want to get a custom treatment plan from your dental care provider to know what options you have and then go from there. It’s best to have at least two options to pick from, even if they aren’t exactly your favorite. Second opinions are usually free, so be sure to have at least 2-3 treatment plans to compare before taking on any major dental expense. Whether your dental bills are for cosmetic procedures or root canals or dentures, make sure the credit limit can cover the dental care.

A dental savings plan to help offset up to 10% to 60% off the costs of dental procedures. Get a discount dental plan here and save!

Here’s a list of common dental procedures and average prices for each dental service cost without insurance.

1. Teeth Cleaning Cost

An adult teeth cleaning usually costs somewhere a little more or less than $100. With insurance, they are usually $0. Keep in mind that the cost of regular dental cleaning fees does not include other services being performed, such as the dental exam and any necessary X-rays being taken.

2. Dental Filling Cost

For one or two surfaces, tooth-colored composite fillings generally cost $90 to $450 without insurance. The average price of a silver amalgam filling is cheaper at $50 to $300 without insurance. Insurance normally covers up to 80% of a dental filling.

3. Wisdom Tooth Removal Cost

A wisdom tooth removal cost without insurance can range anywhere from $250 to $4,000 depending if there's an impacted tooth and needs a surgical extraction.

With dental insurance, you can still plan to pay around $700 out of pocket for wisdom teeth removal.

4. Root Canal Cost

Depending on the tooth, on average root canals are around $800 to $1,600 to treat.

Most insurance plans cover between 50% to 80% of root canal costs.

5. Dental Crown Cost

Depending on the material of the crown and which tooth the crown is placed, without dental insurance, you can expect to pay $800 to 3,400 out of pocket. With dental insurance you around $500 to $2,000 depending on the type of crown.

6. Dentures Cost

For Mid-quality Dentures, you can pay $300 to $800 with insurance and $500 to $1,500 without dental insurance.

7. Tooth Extraction

If you need a tooth removed (excluding wisdom teeth), you can expect the average cost with insurance to be around $25 to $200.

Without dental insurance, expect to pay $75 to $650 depending on whether if it's a simple extraction or surgical extraction.

8. Traditional Metal Braces

If you don’t have dental insurance, there are affordable ways to cover how much braces cost. The average cost with insurance is around $1,750 to $4,000.

Without dental insurance, braces cost on average $3,000 to $7,500 depending on the type and severity of your case.

Using Credit for Dental Care

Most dentists accept credit cards to cover dental work, or they offer 3rd party dental credit cards like CareCredit directly at their office. Dental practices may also run special dental financing options. If you’re worried about paying for treatment, it’s better to finance procedures now while they’re more affordable than to wait for the issue to compound and become more expensive to treat. Credit cards for dental work are a straightforward solution to make it happen with your own payment plans. From elective cosmetic treatments to major oral surgery, you can use your card to pay for treatment that same day, knowing you’ll only need to make small monthly payments toward the balance until it’s paid off.