6 Best Discount Dental Plans | Save Up To 71% on Dental Work

In this article, we may include products or services we think are useful for our readers. If you buy through links on this page, we may earn a small commission to help fund our mission to create more healthy smiles. Here’s our process.

These days, it’s common not to have dental insurance or a plan that you’re unhappy with. Fortunately, dental discount plans are changing the way people afford quality dental care. The best dental discount plans (sometimes called dental savings plans) include discounts on basic preventative care, restorative treatments, smile makeovers, and more. You can use a dental savings plan on anything from cleanings to wisdom tooth removal and everything in-between.

What Are Dental Discount Plans?

Dental discount plans are an alternative to traditional dental insurance plans when it comes to reducing your out-of-pocket costs related to oral health care. You can use your discount card at any participating dental office, no matter where you live. These plans work differently than traditional insurance policies and make it a little easier to figure out how much treatment costs without unexpected bills showing up in the mail a month or two later. It’s not exactly a coupon or a grocery discount card, but the discount process is sort of similar.

Best Dental Discount Plans

1. Carrington 500 + Aetna Dental Access Preferred Plan

Best Overall

1Dental combined the two most popular dental discount plans to get maximum savings for both general and specialist dental services. When you bundle the Carrington 500 with Aetna Dental Access, you automatically get savings on optical and prescription drugs in addition to your routine dental care.

Memberships start at $219/year (individual) and $279/year (families), plus the Carrington 500 membership fee. Your regular checkup is usually 50% off, with average savings ranging from 30-85% on other services. You also get reduced pricing on treatments that normally don’t fall under a typical insurance policy, such as teeth whitening and porcelain veneers. 1Dental offers affordable dental care and is one of the most affordable dental plans and my top recommendations for saving on dental costs.

2. Aetna Dental Access Dental Discount Plan

Best for Dental Specialists

The Aetna Dental Access plan is $149/year (individual) or $189.95/year (families) and covers everything mentioned under the Aetna Dental Access plan listed above, minus the additional prescription drug and optical coverage. Over 140,000 dentist’s offices accept this savings plan. You can start using it within 1-3 days after joining and it even includes pre-existing conditions. It also has a pricing tool to compare costs at different dentist’s offices.

Read the full review here.

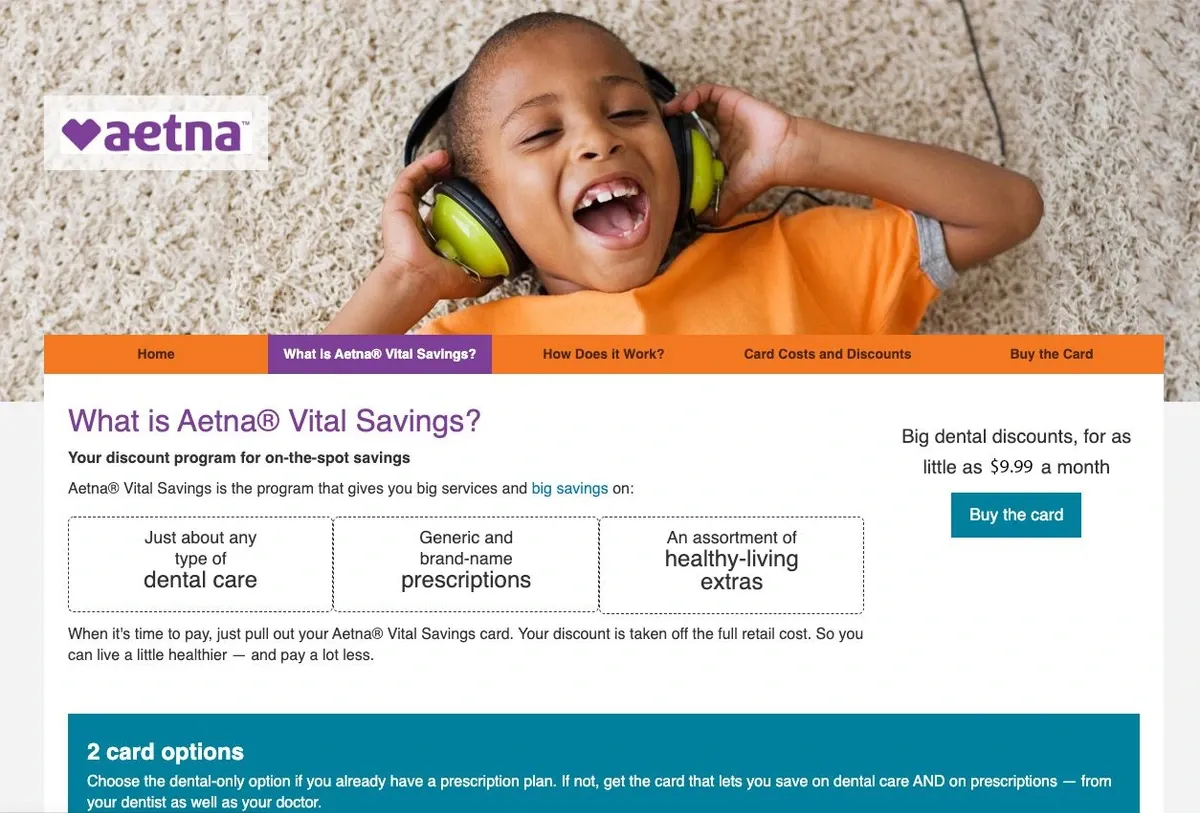

3. Aetna Vital Dental Plus RX Savings Plan

Best Dental Plan with Vision & RX

Membership starts at $164.95/year (individual) and $189.95/year (families) or as low as $13.75 a month. Savings of 26-86% can be applied to practically any dental service, with most covered at 15-50%. There’s even an option to add coverage for prescription and optical. Over 250,000 dental offices nationwide accept this savings plan. Immediate access to preventive care is vital for overall health, helping you save money with pharmacy discounts and other vital savings opportunities. Plus, there’s a “cost of care” tool that allows you to price shop between dentists and prescription discounts in your area.

Read the full review here.

4. Careington Care 500 Series Plan

Best for Specialty Dental Services

This savings plan is about $164.95/year (individual) and $199.95/year (families) on average, but it varies depending on where you live geographically and participating providers. Preventative dental care is covered up to 70% in some situations, whereas specialty services may only be covered at 20%.

Read the full review here.

5. iDental Discount Plan by United Concordia

The iDental Discount Plan is another dental savings plan, not dental insurance. It offers major savings on popular dental services like regular exams, X-rays, cleanings, root canals, and more. Enroll for $134.95/year (individual) or $189.95/year (families) save big on dental programs.

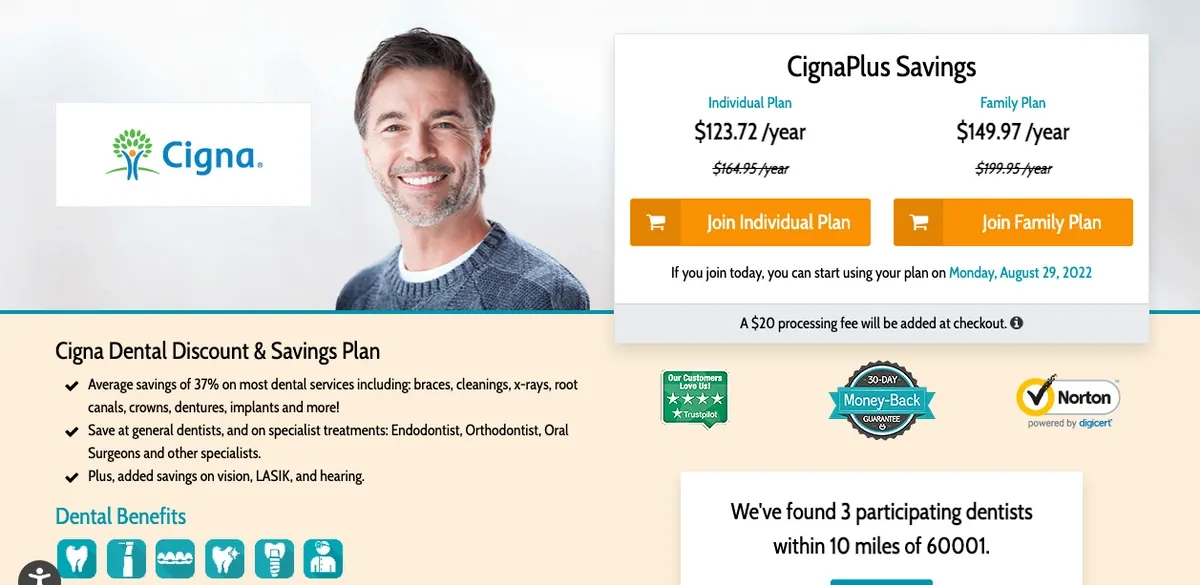

6. Cigna Dental Discount & Savings Plan

CignaPlus Savings Plans are for anyone who doesn’t have dental insurance or doesn’t want dental insurance. The Cigna dental plan gives you a big discount on almost all routine dental procedures, so you can save on everything from dental checkups to smile makeovers (and remember, cosmetic treatments aren’t covered by dental insurance!)

How Does A Dental Discount Plan Work?

Dental discount plans are special memberships that you pay to join that automatically include set discounts on your dental work. But instead of a private membership club that only works at one dental office and nowhere else, your dental savings plan can be used at any participating dental provider nationwide. The best dental savings plans are usually available through major carriers with company names you’ve already heard of.

Dentists and patients alike both enjoy dental discount plans because it eliminates added steps like processing insurance claims and waiting periods on reimbursement checks. Not to mention the frustration of finding out a procedure is denied or not covered at all.

You typically pay an annual membership to join most of the best dental savings plans, or you can opt for a small monthly fee instead. Typically, the cost to join is less than a traditional dental insurance plan. In other words, it’s cheaper to sign up for one of the best dental discount plans instead of purchasing a solo, traditional dental insurance policy.

Dental Discount Plans vs. Dental Insurance

Is it financially smarter to buy traditional dental insurance plans or go with an alternative dental savings plan? Let’s do a compare-and-contrast between dental discount plans and traditional dental insurance coverage based on a couple of common scenarios how dental savings plans work:

Here's an example….

Option 1: Paying For Dentures With Traditional Dental Insurance

The cost of dentures without insurance services is somewhere around $600-$1,000 depending on the type you chose and where your dentist is located. With insurance, it drops the fee to somewhere between $300-800. Unfortunately, the bulk of your insurance benefits is set aside for things like cleanings and fluoride, which you don’t need if you’re wearing dentures. Once you’ve paid your monthly premium plus your deductible, you might be paying nearly double the amount for dentures than you would if you were just paying in cash.

Option 2: Denture Cost With A Dental Savings Plan

Some of the best dental savings plans cover as much as 55% for dentures and other types of tooth replacements. So, the cost is about the same or less than the fee with dental insurance. Except, in this case, you’re also saving on the deductible and monthly premium, so dentures are cheaper with a membership plan than they are with dental insurance. Seniors won’t have to pay for monthly premiums to cover services like prophylactic teeth cleanings when you don’t even have teeth to clean.

Discount Dental Plans Pros:

There is no waiting period, estimates, or deductibles with a discount dental plan, and you won’t have to worry about whether or not you have enough dental coverage to pay for a procedure you need. The discount is applied to practically every single service you need (or want, in the case of cosmetic treatments.) Use it on dentures, veneers, braces, or whitening, it doesn’t matter.

Dental Insurance Pros:

If you don’t tend to need much work beyond your typical checkup, cleaning, and X-rays, your dental insurance will normally pay for itself after your six-month visits. Plus, if you do need minor treatment every now and then, you’ve usually got up to about $1,500 in dental insurance benefits to apply to your treatment plan. Dental insurance can be great if it’s offered by your employer and you have good oral health but want a backup if there’s a cavity that pops up unexpectedly.

Are Dental Saving Plans A Better Option?

Honestly, I feel like it’s financially smarter to join one of these best dental savings plans vs. enrolling in your own private insurance plan. Here’s why: you don’t have to worry about annual maximums, paying deductibles, estimating your treatment costs, running out of benefits, waiting periods, or wondering if your insurance policy is going to cover something (and by how much.) With discount dental programs, you pay an annual membership fee to join the program and you get immediate fee reductions at practically every visit. Plus, a dental discount program is cheaper to join than paying extra every month for a dental insurance policy that might not even cover what you need. The only downside is you’ll obviously want to check to see if your preferred dentist accepts dental discount plans (and which ones.)

What Dental Services Do Discount Plans Cover?

Depending on which discount dental plan you’re a member of, you can get coverage on the different categories of treatments/services:

1. Preventative Dental Care

If you’re using traditional dental insurance, preventative dental services like teeth cleanings and checkups are usually $0. But with a discount dental plan, you’re taking a fixed amount off of your checkups, so you’re still paying a fee, except it’s significantly reduced. You’ll save on preventive care from the exam to your dental X-rays.

2. Restorative Dentistry

When you need to repair or replace teeth with dental fillings, dental crowns, root canals, bridges, or implants, you automatically save on your treatment plan. Depending on which dental discount plan you’re using, the fee may be reduced by about 50% (give or take.)

3. Oral Surgery

Planning on having wisdom teeth removed sometime soon? Need a sinus lift or soft tissue graft for dental implants? Recovering from periodontal disease? Your oral surgery fee may be reduced by over half.

4. Orthodontics/Braces

With a great dental discount plan, you can easily save a couple of thousand dollars on traditional braces or clear aligners, depending on the brand and which office you’re at. And unlike dental insurance, there are no age cut-offs, so adults can enjoy this perk too.

5. Cosmetic Dentistry

Elective services like dental veneers or teeth whitening aren’t “necessary” when it comes to your health, so they typically aren’t covered by dental insurance. But most dental savings plans will include a discount on cosmetic procedures.

How to Save on Dental Care

If you’re still a little skeptical about joining a membership or dental savings plan, here are the most popular ways to save on your average dental appointment.

Once you’re able to understand how each option works, you’ll feel a little more comfortable knowing that the decision you make is the right one for you and your family:

1. Dental Discount Plans

The best dental discount plans (like the ones mentioned above) are accepted at countless dental offices across the country. Depending on which plan you join, your savings may vary slightly. Be sure to look at things related to elective dental services (for cosmetics) and oral surgery, especially if you’ve got a teen who needs their wisdom teeth removed. And most importantly, check to see if your dentist accepts the dental savings plan or if you have options in your area where the participating dentists are accepting new patients.

Another type of dental discount you might consider is asking the office if they have reduced fees for seniors, first responders, etc. Some offices even offer cash discounts if you’re paying 100% out of pocket for each service. It never hurts to ask!

2. Dental Membership Plans

Similar to dental savings plans, membership plans are usually run by your specific dentist’s office as an alternative to discount plans. The membership typically includes your regular checkups with added discounts on all additional services, so the membership fee is typically higher than a dental savings plan. These are only available here and there, depending on your dentist’s office.

3. Dental Schools

If you have a dental school in your area (or a dental hygiene school, for that matter), you can get extremely cheap dental treatment without sacrificing the quality of dental care. Most dental schools have fees that are half or less than a traditional dentist’s office. The downside? You’ll probably have to wait at least a few months before you can get in for an appointment.

4. Shop Around

It’s practically impossible to get a dentist’s office to quote you a price over the phone because there are so many variables that come into play with the cost of dental procedures. But if you’re open to visiting 2-3 different dentist’s offices for free consultations and then comparing their treatment plans, you can figure out which one is the cheapest.

Since some dental discount plans have online price comparison tools, this is a great added option to save on top of your savings plan.

5. Payment Plan With The Dental Office

Most dental offices will either have some type of an in-office or 3rd party financing plan option. It might be 0% interest if you pay it off within 12 months, low-interest financing, or simply breaking the payments up into 2-3 increments. Or, in the case of orthodontic offices, you usually pay a monthly fee instead of all of it upfront.

Are Dental Savings Plans Worth It?

If you don’t have insurance or dental coverage, the best dental discount plans take the pain out of paying for visits to the dentist. They potentially save you hundreds to thousands of dollars on dental care, not to mention the headache out of processing insurance claims or waiting on reimbursements. Dentists and patients alike enjoy the convenience and clarity that dental savings plans offer, which is why so many offices accept them.